Private market firms are sitting on an enormous volume of information - but for many, the value of that data remains locked away in fragmented systems, spreadsheets, and manual workflows. The outcome is familiar: inconsistent reporting, delayed insights, and operational inefficiency that slows both investors and managers.

To stay competitive, firms must recognise that the real challenge isn’t collecting data - it’s making it consistent, connected, and usable.

The Reality: Private Market Data Is Losing the Battle

Unlike public markets - which face their own data challenges - private markets remain significantly further behind.

After years of rapid expansion and product innovation, the industry has prioritised growth over data infrastructure. Now, as alternative managers lock in on the wealth opportunity, the pressure to invest in automation and data foundations is intensifying. Each deal, fund, and co-investment introduces new data silos - often managed in isolation by administrators, deal teams, and portfolio managers. As a result, firms face a growing set of structural challenges that limit transparency, timeliness, and scalability:

Data Fragmentation

Information sits across fund administrators, Excel sheets, CRMs, and bespoke deal systems. Without a single source of truth, reconciling exposure, performance, and risk becomes an operational headache:

In a market where speed, precision, and investor confidence define competitiveness, this fragmented model simply doesn’t scale. To compete effectively, private market firms must move from reactive data management to proactive, governed, and scalable data operations.

Turning Data Complexity into Competitive Advantage

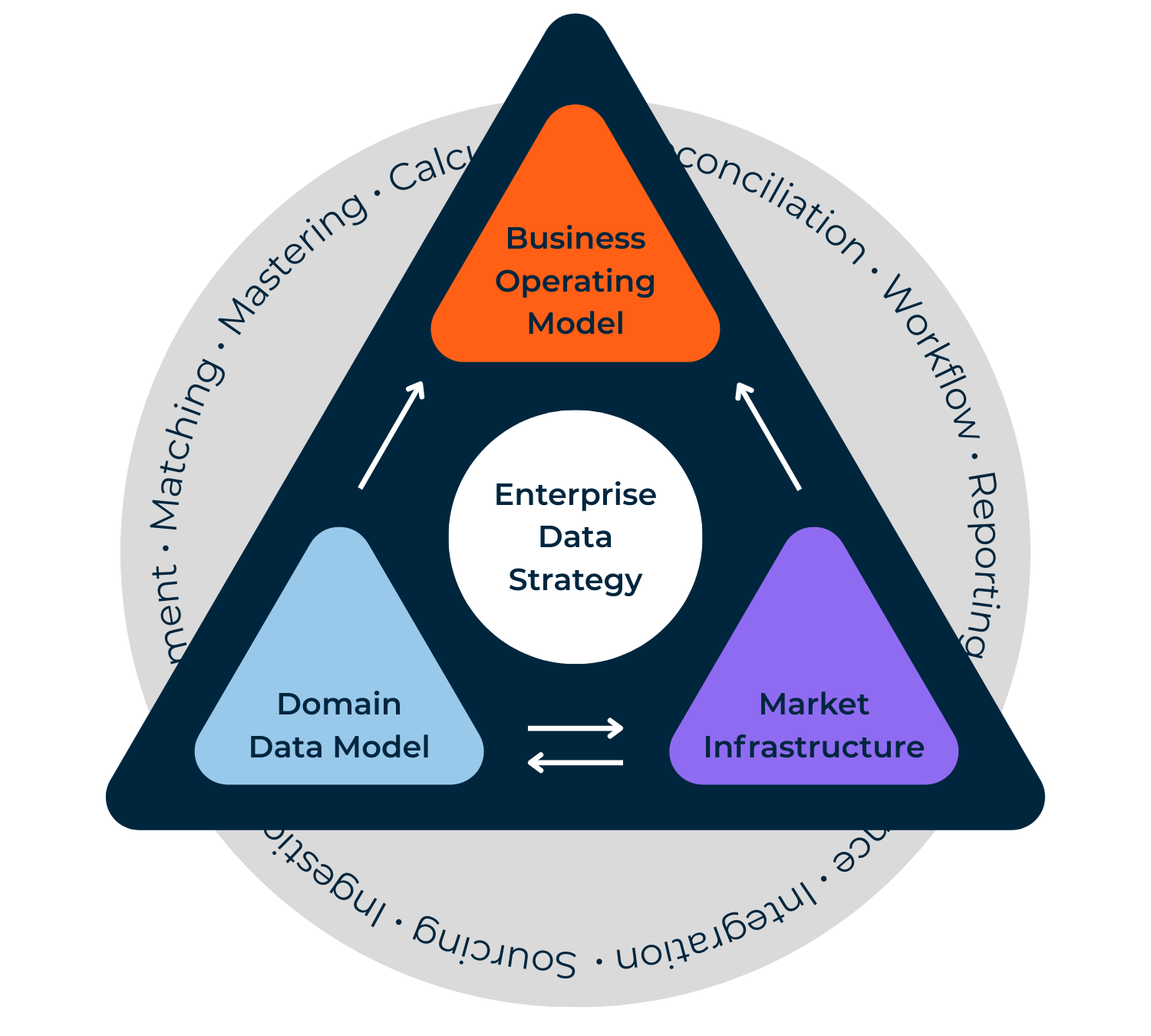

Winning the data battle doesn’t happen overnight - it requires a robust, enterprise-wide data strategy that connects every layer of the private markets ecosystem: funds, deals, investors, and portfolio companies.

At Aiviq, we’ve seen that leading firms succeed when they focus on three core pillars that directly address today’s private market data challenges:

1. Unified Data Model

Establish a golden source for fund, deal, and investor data: A unified model eliminates fragmentation, improves timeliness, and provides a consistent, trusted view of exposures, valuations, and performance across all systems and administrators.

2. Operating Model & Governance

Define clear data ownership, stewardship, and accountability across teams: Governance frameworks enforce data standards, maintain quality, and ensure regulatory readiness - turning stewardship from a manual task into an embedded, scalable discipline.

3. Scalable Technology Infrastructure

Move beyond point-to-point integrations with modern, cloud-native architecture.

API-driven pipelines and automation frameworks enable interoperability across fund accounting, CRM, portfolio monitoring, and investor systems - unlocking real-time access, transparency, and continuous improvement.

Together, these pillars transform data from an operational burden into a strategic advantage - enabling firms to act faster, report confidently, and scale with the growing complexity of private markets.

The Payoff: Actionable Intelligence, Not Just Better Reporting

When private market firms align their data strategy, governance, and technology foundations, the impact is transformational - not incremental. With Aiviq, data stops being a back-office problem and becomes a strategic advantage - powering faster insights, sharper decisions, and stronger investor confidence.

The results speak for themselves:

- Trusted reporting - accurate, auditable, and investor-ready from day one

- Total client clarity across funds, vehicles, and commercial relationships

- Automation at scale - from subscription docs and onboarding to reconciliations and enrichment

- Analysts focused on insight, not admin, driving value instead of reconciliation

- Regulatory-ready data lineage, simplifying compliance with SFDR, AIFMD II, and SEC requirements

- Lean, integrated operations that reduce cost and friction across platforms

- A culture of intelligence, where trusted data drives growth and confident decisions

And once firms establish a foundation of clean, connected data, they can go further - unlocking the next layer of intelligence through Aiviq Client Intelligence. By combining advanced analytics with AI-driven models, Aiviq empowers managers to spot flow trends, receive dynamic executive briefings, anticipate client behaviour, and identify growth opportunities - before the market does.

%20-%20Edited.jpg)

.jpg)